Project Passive Investing Through a Crisis

UPDATE: July 2023

It's time to retire the monthly Project Passive updates until the next big 'thing' impacting markets.

I've enjoyed writing and sharing this real time diary for the last 3.5 years and appreciate the feedback I've received.

I'll fire it back up during the next market crash.

See you then.

Introduction

I got so much out of Benjamin Roth’s fantastic book The Great Depression: A Diary, while enjoying all a European summer has to offer in July-August 2019, I’ve decided to keep a diary during this COVID-19 Crash (or whatever it will be labelled in time).

I enjoyed the real time thoughts and insights Ben Roth shared as he was navigating what turned out to be the Great Depression and in real terms lasted more than a decade. It's too easy to look back with twenty-twenty vision after history has play out as a 'Monday morning quarterback' and things are as they currently are.

Making decisions, especially good ones, in challenging times with so much unknown, so much fear, so much noise, so much panic and uncertainly can be a challenge.

Additionally, I resonate with Naval Ravikant thoughts on wealth, money and status.

He says: "Seek wealth, not money or status. Wealth is having assets that earn while you sleep. Money is how we transfer time and wealth. Status is your place in the social hierarchy.

You're not going to get wealthy renting out your time. You must own equity - a piece of a business - to gain your financial freedom.

Ignore people playing status games."

A lot has changed in the world in the past week or two and I’m certain the only certainty is more change.

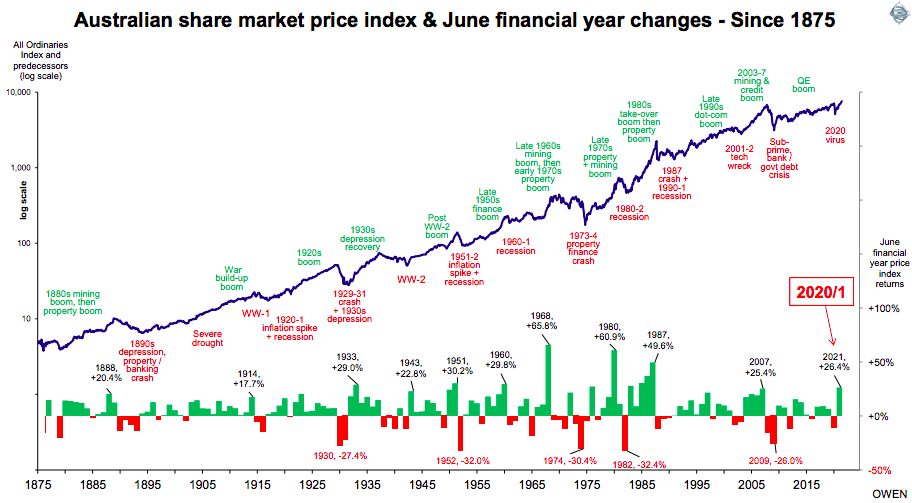

As share prices started to drop towards end of February, I started to buy more. Over about four weeks, the markets contracted by around 35% at time time of writing this.

Keep in mind none of this is financial advice. Far from it. Jim Rohn said 'the same wind blows on us all', never truer words spoken.

Hindsight bias, home country bias, anchoring, confirmation bias, loss aversion, etc can all creep in at times. Few humans are immune.

I'm simply sharing my thoughts and actions to keep myself accountable, in real time, on the journey.

Podcast:

If you'd prefer to listen to Project Passive instead of read, check out the 'Healthy Business' Podcast available on Apple, Spotify and all podcast platforms.

https://open.spotify.com/show/6bNFcmBZmpWYEAIGckluMY

May & June 2023

It’s been a couple of months since the last update. I happily got distracted preparing and going on an epic surf trip to the Maldives with my brother and some friends.

April 2023

With interest rates in a rising cycle, there’s discussion around getting a 4% return in the bank with no fluctuation of capital. Over time my view is who’s to say what anyone else should do with their money. I share these updates to keep myself accountable in real time and hopefully others might find some value in what I’m sharing.

March 2023

A bank in the US called SVB (Silicon Valley bank) has come undone. This is a large bank that holds deposits for a huge number of startups. Turns out the depositors have lost access to the money via a run on the bank.

February 2023

The RBA upped interest rates another 0.25% today to a new cash rate of 3.35%. It’s their 9th continuous interest rate rise.

The majority of people with debt and fixed cash flow will will start feeling a pinch sooner than later.

January 2023

For non-Australian residents reading, the RBA meets on the first Tuesday of every month (except January) to reveal their interest rate decisions. Being January and clearly we’re in a rising interest rate cycle, debt holders are no doubt enjoying the RBA’s month off!

December 2022

The bias in the mainstream media is criminal as far as I'm concerned, so it’s encouraging to see what Elon’s done with Twitter in a couple of short months. From the Twitter Files in relation to Hunter Biden's laptop, to being a place where accurate information and questions are being asked.

November 2022

Overnight the FED increased interest rates another 0.75% with comments indicating interest rates will go higher than expected and inflation is more of a challenge than previously thought.

The market’s response was what you’d expect, a lot of red.

October 2022

The ASX is flying up today. The RBA upped interest rates 0.25% this month to 2.60% and the ASX jumped another 1% after the announcement. It finished up over 3% for the day.

Who’d have thought?

September 2022

Last week BHP and Rio Tinto transferred a combined $20billion dollars to shareholders. This week sees another $5 billion dollars from names including Fortescue, CSL and Brambles.

$42 billion in dividends are being sent to investors bank accounts this month. Shareholders received $45 billion dollars in the December half year dividend payments.

August 2022

The RBA upped interest rates 0.5% again today, taking the cash rate to 1.85%.

Property is a religion here in Australia and why not, it’s a beautiful part of the world to have a beautiful property. As interest rates start to rise there’s rumblings of the stupid prices paid recently toning back a little. Perhaps revision to the mean in action. As always, time will tell.

July 2022

Today marks my 18th birthday working with USANA, the Cellular Nutrition Company. I’m finally an adult in the business! What a gift it’s been. I don’t have words to express how much I’ve learnt about health, human behaviour, leadership, events, culture, ups and downs, the media, friendship, support, courage, persistence, fun, creating change and the list goes on.

June 2022

The RBA raised interest rates 0.5% today to a cash rate of 0.85%. Their stated goal is to reduce inflation to 2-3% long term. They did however say inflation may get worse before it gets better.

Unless you’re living under a rock or off grid, inflation is running rampant.

May 2022

So here’s a story for you. My brother and I surfed Snapper Rocks this afternoon. It was a magical day with incredible waves. Then out of nowhere, disaster. My brother got his legs pinned between two cars. He’s what happened in his words:

April 2022

Today was a big day. My uncle’s funeral, paddle out and wake in Torquay. The family were expecting 200 to maybe 250 people to attend. Over 800 came to celebrate his life with another 150 with us on the live stream. It was epic to spend more time with my extended family while at the same time it’s sad that it took a death to connect like we did.

March 2022

An interesting article titled ‘The Top 1% Invest 61% of Their Wealth In One Asset Class’ popped up on Livewiremarkets.com. That one asset class is equities and it sure created some debate!

I don’t understand why. Actually cancel that, I know exactly why and it’s stupid. Ego and attachment doesn’t serve anyone well long term. While I have my investment preference, it’s doesn’t blind me to the reality great returns can be made on any asset class with the right temperament.

February 2022

The RBA kept rates on hold today, no surprise considering there’s a federal election in a few months time. They did announce an ending to the bond-buying program kicked off in April 2020.

January 2022

Morgan Housel tweeted this from Michael Batnick’s blog, The Irrelevant Investor. It’s wisdom:

‘Investors don’t necessarily get better with experience because markets are adaptive, unlike most of our learning environments. I won’t ever touch a hot stove again on purpose because I know it’s hot. I won’t go in a cold shower because I know it’s cold. But “I won’t ever buy stocks again when the CAPE ratio is above 25 because I remember 1999” is not the same thing

December 2021

The FED Chair has thrown a spanner in the works with comments a few days ago around inflation no longer being ‘transitory’. Turns out it’s permanent. They’re cutting back their $120 billion a month asset buying faster than they originally planned too.

November 2021

Yesterday the RBA kept interest rates on hold. The big change this month was the cutting of one of the Central Banks key stimulus measures known as ‘yield curve control’, which they kicked off in March 2020 during the peak of the stock market correction.

October 2021

The market is down close to 3.5% so far today. The headline tonight was: ‘$47 billion dollar sell off’. Shares are doing their thing going up and down as they always have and always will.

September 2021

Over night the S&P 500 hit its 54th record high close of the year. Imagine having sold out after it’s first all time high this year. You’d have missed the further 53 record closes so far and the dividends paid since the first one.

Peter Thornhill explains it this way. We’re investing in human endeavour, when we invest in shares. It’s people and their ideas, skills, innovation and vision who create and run businesses all around the world. This is what investors are investing in.

August 2021

Surprise, surprise our three-day lockdown has been extended a further five days to Sunday 4pm this weekend.

The market doesn’t seem to care though, it’s flying! Up 1.5% today in Australia and internationally.

YouTube has censored some of Sky News Australia’s videos on their platform, which is criminal, especially now.

June 2021

xxx gave me a fantastic analogy this morning. I was telling him its difficult dollar cost averaging at the moment, as share prices are sky high, but I stick to my plan and do it anyway.

Using VAS as an example (currently at $92.40/share) he looks at the price as being $920,400. It’s your ‘house’ that you can buy in parcels over time.

The management fee of VAS is 0.1% meaning it ‘costs’ $1000 a year to manage your ‘house’ if you have $1,000,000 worth of VAS.

May 2021

May the fourth be with you… sorry bad joke.

Berkshire Hathaway’s Warren Buffet and Charlie Munger streamed their annual meeting online recently, taking investor questions for over three hours. It’s always interesting. Here’s the link to listen: https://www.youtube.com/watch?v=gx-OzwHpM9k

April 2021

USANA launched stage one their Active Nutrition line to their affiliates today. A fantastic range of shakes and bars that are all gluten free and non-GMO and with some diary free and vegan friendly too. I’m pumped incorporating the snack bars daily and adding the plant based protein digestive shake that’s also got medium chain triglycerides in it, to my daily shake.

March 2021

Zipped up to Mt Tambourine this morning to pick up the second edition of The Budo Karate of Mas Oyama; I first spoke about in July last year.

They’ve just landed here in Australia yesterday. This is the updated and expanded edition after it’s first publication in 1987. It’s an incredible book. I’ve added a link to purchase on the resources page. Even if you’ve no interest in Martial Arts specifically, the philosophical aspect alone is worth it, especially in today’s world.

February 2021

The RBA met today, kept rates on hold and committed to buying another $100 billion dollars in bonds. I’ve lost count how of many hundreds of billions of dollars of bonds they’ve bought since March 2020.

This announcement sounds like they’ll extend their quantitative easing beyond the planned April cut off. It seems an insane amount of fiscal support especially and I quote ‘the economic recovery is well under way and has been stronger than was earlier expected’.

January 2021

Enjoyed breakfast with an old school friend, training partner, athlete client and business partner this morning. Ironically we somehow got onto the topic of investing. I’d never have thought, knowing each other since 1990 that we’d be sitting at breakfast 30 years later discussing investing with such enthusiasm. Ain't life grand!

December 2020

The short story is the RBA met yesterday saying we’ve ‘turned a corner’ economically and they’ll ‘look to do more if necessary’ depending on jobs and inflation data.

Feels like we maybe in for another bull run in property and shares and to be more specific, the gap between those who own assets and those who don’t will widen.

November 2020

The Reserve Bank of Australia today did as many expected, cutting the cash rate to 0.1% and announced a $100 billion dollar government bond buying initiative over the next 6 months.

They also signalled they further measures if necessary, which is interesting, because they’re now stepping out of their original role and into a newer role in attempting to have 2-3% inflation (which no central bank as been able to do for a decade).

October 2020

Leader of the free world Donald Trump this afternoon tweeted he’s contracted COVID19. It’s so bad he needed a test to confirm he and his wife now have it after coming into contact with one of his staff that had it.

xxxx messaged letting me know that and the ASX dropped over 1% upon the news. So I added to my Australian holdings. Lowering the cost base never gets old.

September 2020

Over night Apple and Tesla shares split, one for four and one for five respectively I think. But that aside, these company’s equities (and a few other tech companies) have been going up, in what feels like a straight line, for a while now.

I read retail investors have been piling into Apple and Tesla more than anything else and NAB Trade have confirmed this for Australian’s buying US stocks.

August 2020

Daily COVID cases in Melbourne, Victoria has been rising enormously the past week or two, from the human error Premier Dan Andrews made not using Police and/or Army for enforced quarantine.

Looks like they’ll go into stage 4 lockdown, meaning enforced lock down from 8pm – 5am everyday for the next 6 weeks and only leaving the house for an hour a day for exercise and/or essential food shopping, employment, education or medical and driving no more than 5km’s from home.

July 2020

This morning trained with Kyokushin Karate Shihan Cameron Quinn. He kindly gave me a copy of the 2nd edition of his incredible book, first published in 1987 called ‘The Budo Karate of Mas Oyama’ to proof read, as it’s being updated and republished later this year.

It’s an honour to proof and I seriously cannot put it down!

June 2020

A bunch of restrictions get lifted today around our state of Queensland and all states in Australia. Each state is different, ours being one of the stronger virtue signalling states that feels the need to maintain over the top restrictions.

A friend messaged me this morning the stats about those who opted for early release of their superannuation. So far it’s been spent like this:

May 2020

The DOW closed down 1.17% over night.

ASX closed down 4.2% today.

Was a magical day today and after a great surf with great mate PRW we got talking about living a great life. It’s simple as stringing enough great days together to end up as a great life. One day at a time! Today was certainly a great one…

April 2020

We’re now at 4,800 cases and 21 deaths in Australia. Globally there are 857,500 cases and 42,107 deaths as of midday today.

There’s another statistic that’s rarely reported, the number of people whom have made a full recovery from COVID-19. It’s in the 1000’s! In Italy, I believe a 101yo male made a full recovery from it and he made it through the Spanish Flu and every other pandemic, depression, recession, war and crisis we’ve had over the past 100 years.

February - March 2020

What a crazy time! This virus that’s apparently originated out of a city in China called Wuhan, is sweeping the world.

I’ve kept notes here and there on my phone and computer of different points of interest and situations. One being I was down in Melbourne having an absolute blast at Australia's first wave pool called Urban Surf with my brother and some friends. It was being reported state boarders were about to be closed and Victoria was to shut down that night.